Venture: High-Tech Steel

Issue 61;

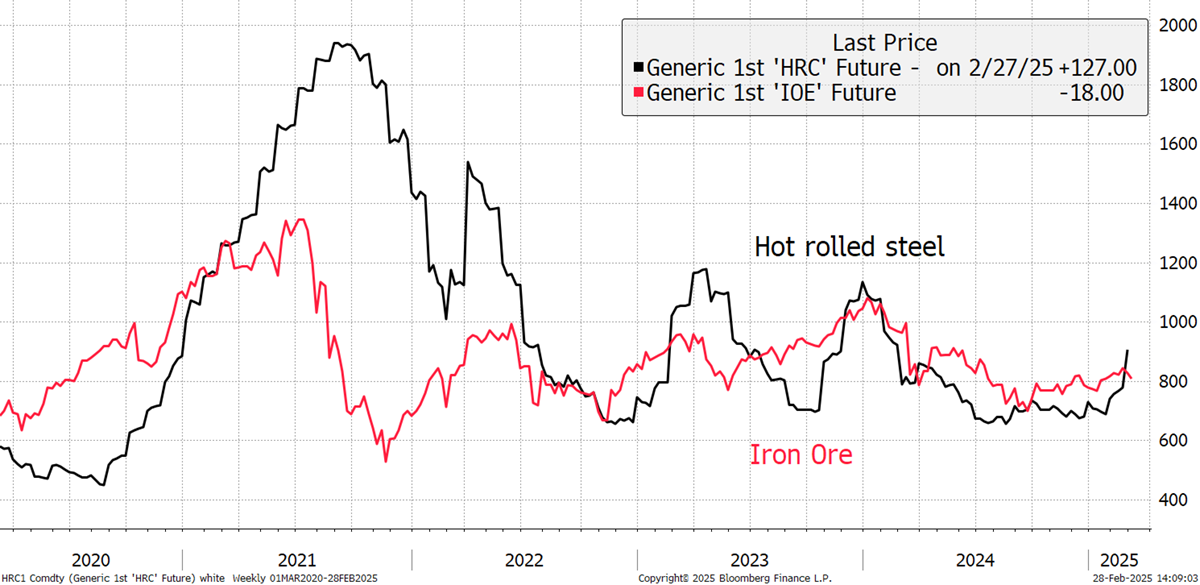

The price of steel has started rising while iron ore remains soft.

Iron Ore and Hot Rolled Steel Futures

I asked Grok (AI on X.com) why iron ore is down, and steel is up.

“Iron ore is down due to weak demand, ample supply, and a shift to scrap, while steel is up due to supply constraints, higher production costs, and regional market reactions to trade policies. These diverging trends highlight the complex interplay between raw materials and finished goods in the global steel industry.”

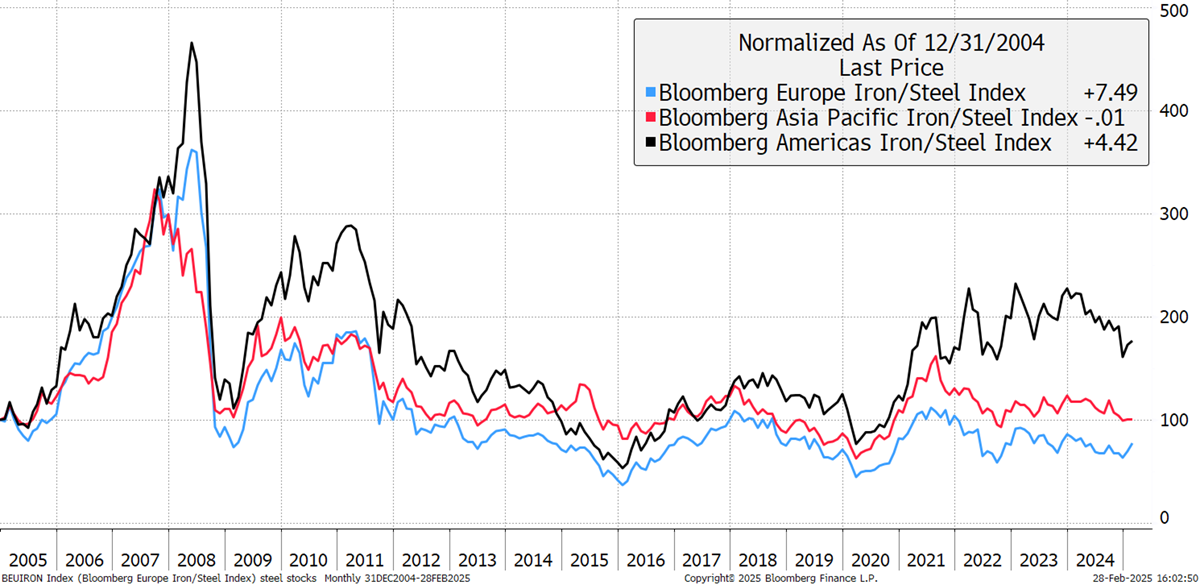

I then looked at steel stocks and was surprised by the extent of the current divergence. US steel stocks have recently eased back but are way ahead of both Asia and Europe, which have lagged significantly.

Regional Steel Companies

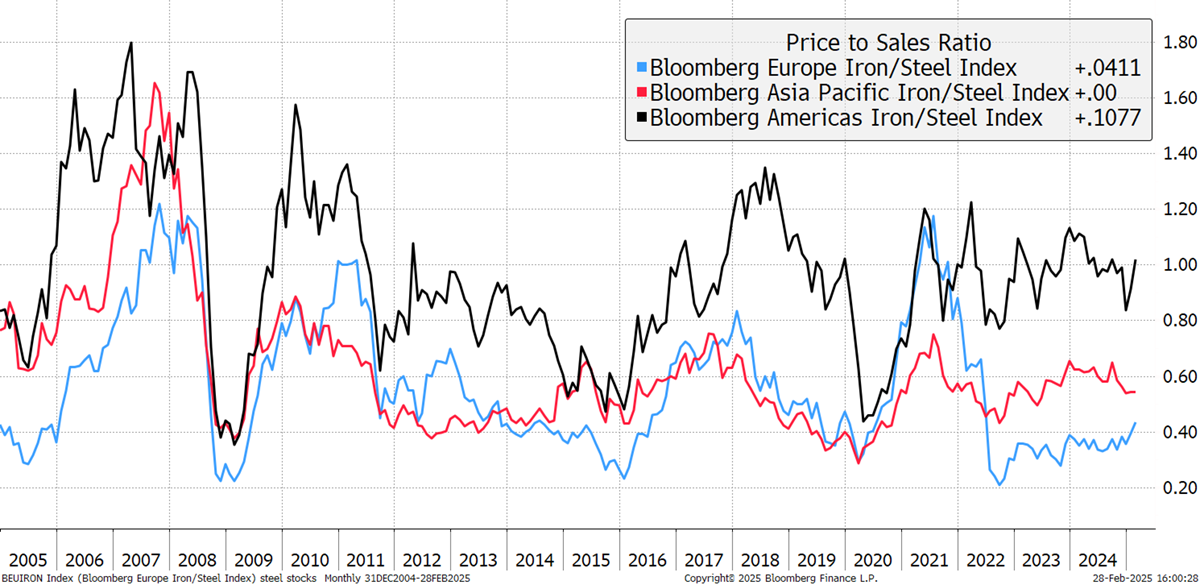

Looking at the price-to-sales ratios, the US companies are trading at 1x sales, Asia Pacific at 0.55x and European companies at under 0.4x. You could say that European steel companies have a structural discount, likely due to higher energy costs and regulation, but the gap is wide.

Regional Steel Companies Price-to-Sales Ratio

I would add that the political landscape is changing in Europe. Mario Draghi, the former European Central Bank President, wrote a long overdue report on European competitiveness, which outlines how the block needs to up its game.

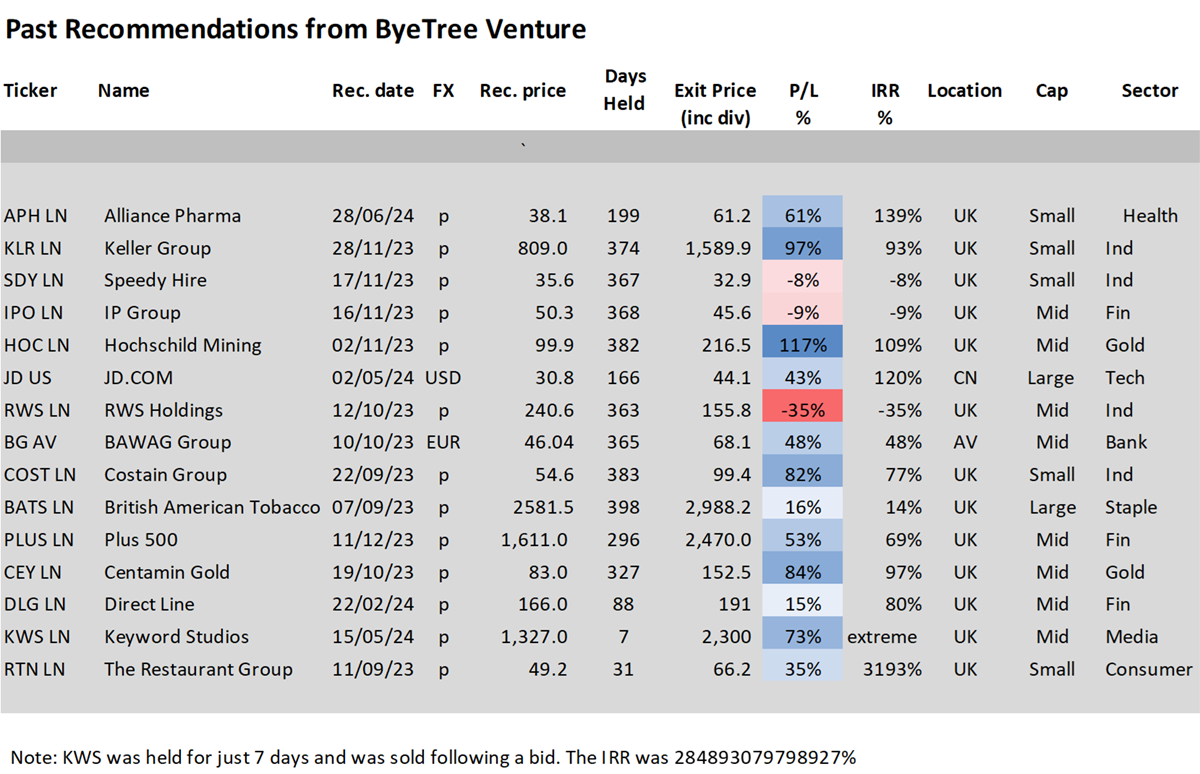

This note covers a high-tech European steel business that is not only debt-free and profitable but sits on a cash pile greater than its market cap. Not only that, but it is also a global leader in the refined steel industry, with roots dating back to 1914. The recent jump in steel prices could provide the catalyst for a revaluation. This is another free equity with a great business thrown in for nothing.

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd