Venture: UK London Property

Issue 63;

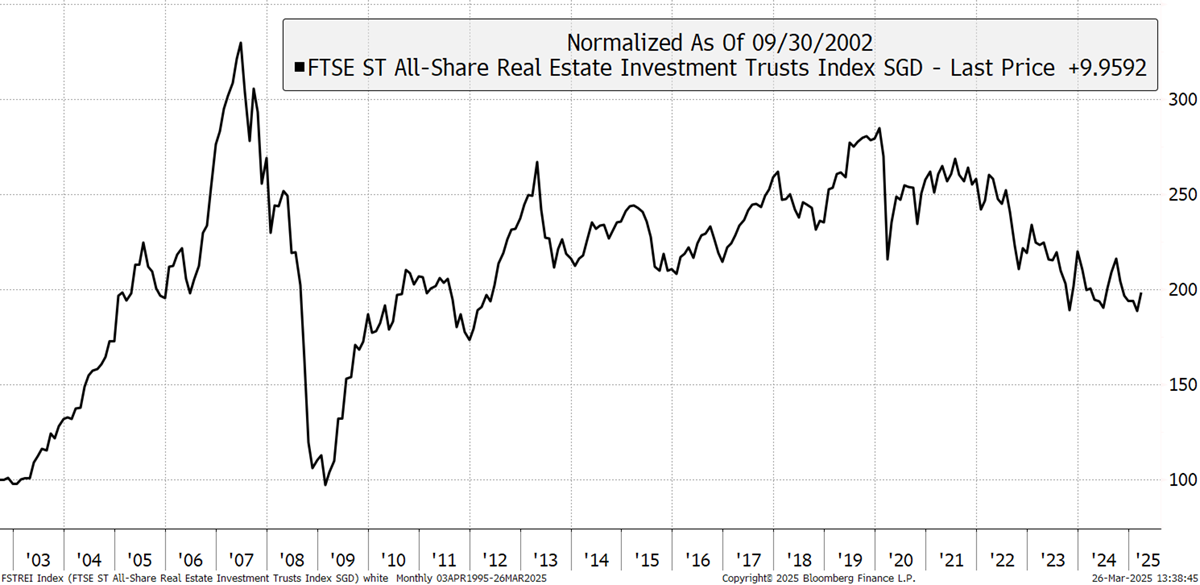

The property market has faced tough conditions in recent years. UK-listed property trades at roughly the same levels as it did in 2005. A property boom preceded the financial crisis of 2008, and the market never quite recovered thereafter. Then came the pandemic, where people worked from home, which was soon followed by the surge in interest rates from low levels.

UK Property Sector since 2003

However, bad news can be good news when it comes to buying stocks because prices are low. What we are starting to see is a shift towards companies demanding employees return to the office, accompanied by a gradual recovery in the demand for office space, alongside firmer rents. The economy may not be on fire, but the commercial property market has likely seen the worst.

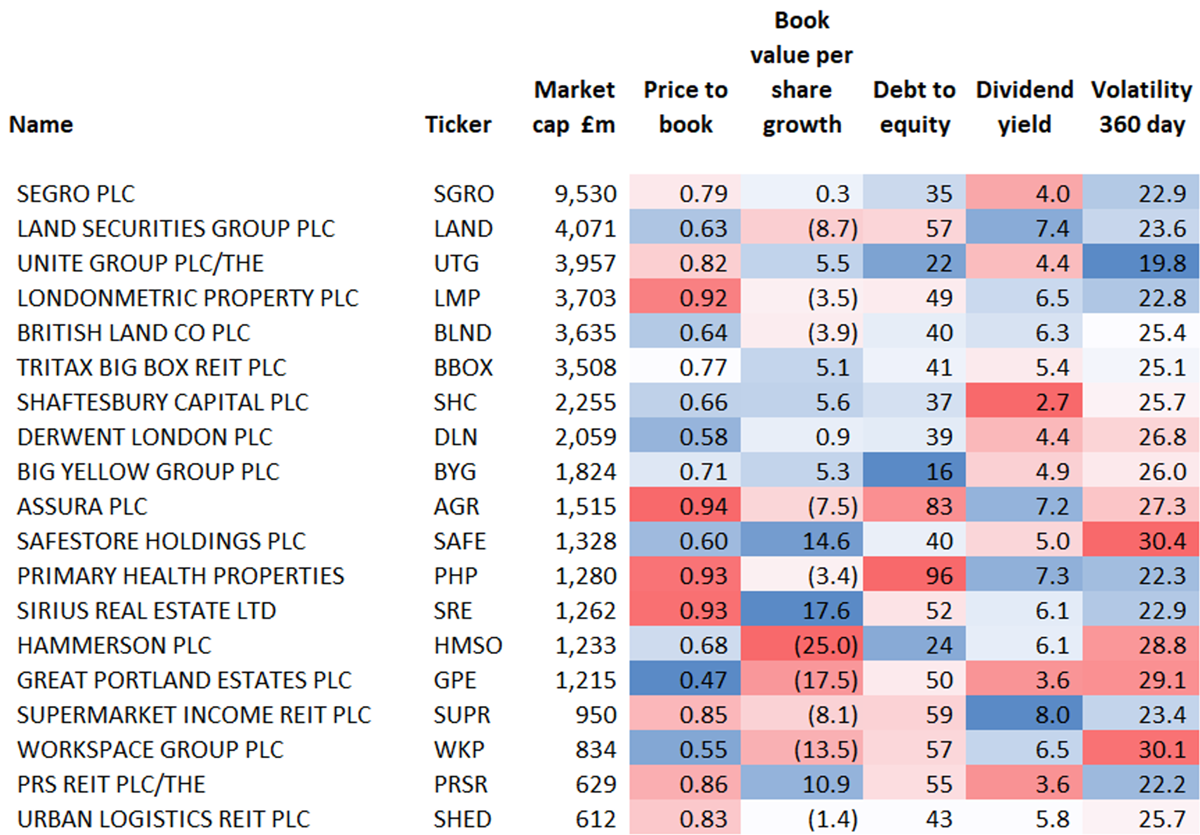

I show the major UK Real Estate Investment Trusts (REITs), all of which are trading below the book value. That means the buildings are worth more than the companies that own them. In the heady days, it’s the other way around, as the shares are worth more than the properties. Business is recovering, yields are attractive, and the sector has calmed down, as seen by lower price volatility.

Major UK REITS

If you’d like to see which REIT caught my eye, please read on.

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd