Black Smoke, Gold, and Bitcoin

Trade in Whisky;

I hope you had a good Easter break. If you were watching US markets on Monday, you may have been surprised by the market’s reaction to the Pope’s passing. Digging a little deeper, I discovered it was President Donald Trump who had branded the Federal Reserve Chairman, Jerome Powell, “Mr Too Late” in a public attack.

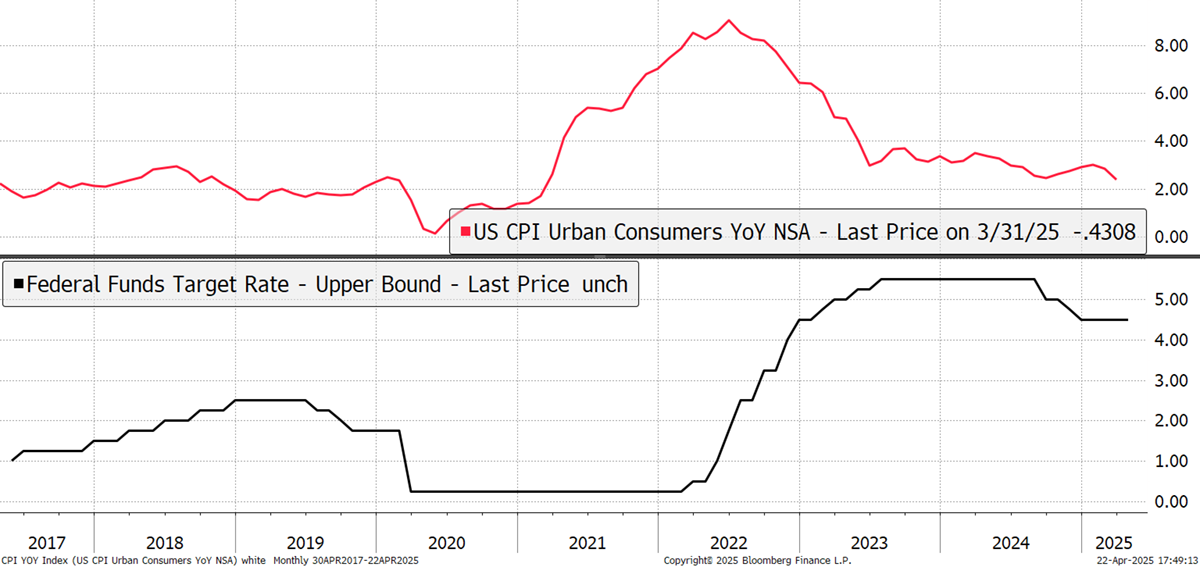

The markets didn’t like it because the Fed is supposedly independent. Trump wants interest rates down to boost growth and believes inflation (2.4%) is close enough to target (2%) for the cutting cycle to continue. Trump has a funny way of saying what everyone is thinking: Where are the rate cuts? He just has a blunt way of saying it in very simple terms.

US Consumer Inflation and Interest Rates

Powell was appointed to the Fed in 2018. He was criticised for being late (too late) to hike rates in 2022 when it was already obvious there was an inflation problem the year before. The first hikes in 2022 took place just as inflation was peaking during the pandemic. Some blame the pandemic economic shock, but the supply-side economists blame the surge in the money supply at the time. I’m with the latter camp, with the shortages adding fuel to the fire. Now they blame him for being too late again, as inflation has come down, yet rates remain high by post-2008 comparisons.

The Taylor Rule, a model based on rates, unemployment, and nominal GDP growth (which includes inflation), favoured by the central banks, suggests interest rates should be 6%, and Powell is waiting for that model to start falling. For that to happen, he would need to see evidence of an economic crash or a surge in unemployment. Many indicators point to that, but it isn’t yet conclusive. Trump thinks it’s inevitable, hence, Powell is too late again.

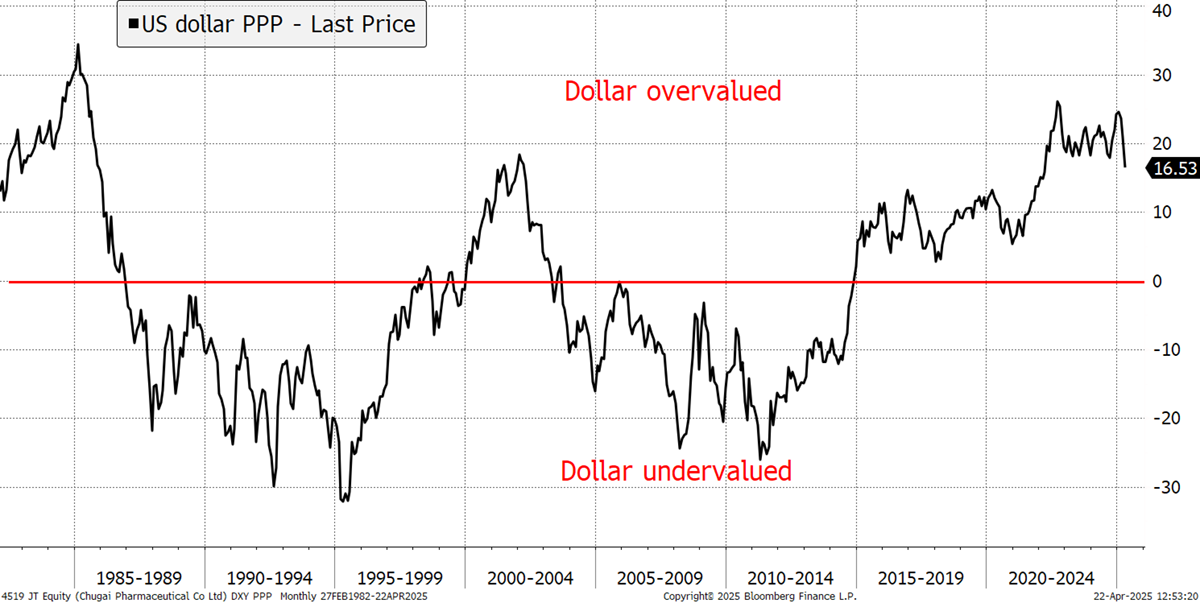

The problem with this spat is that it’s a constitutional issue. The Fed has independence in setting monetary policy, just like the Bank of England had after the Labour victory in 1997. White House interference in US monetary policy hasn’t gone down well with markets. The dollar has fallen 12% since January, while bond yields have remained high. It has caused a great deal of uncertainty among investors, and confidence in the USA is another step lower than it was a few months ago.

Then Trump clarified that he had “No intention of firing Powell. None whatsoever… I would like to see him be a little more active in terms of his idea to lower interest rates.”

Markets are up today on the news, and there’s a sense that his tactic might have worked, and interest rates will start falling again soon. At least a rally has begun.

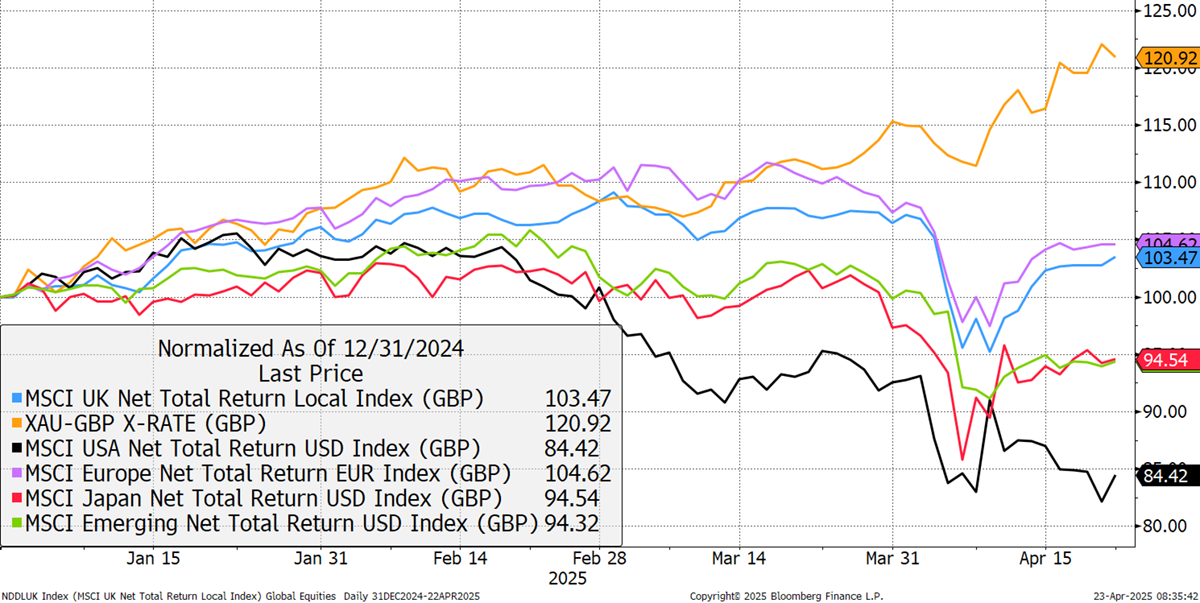

The US stockmarket is now down 16% this year. Europe and the UK are up slightly, while China and Japan are off, but not by much. Gold has been the star but has started to ease back.

Major Markets Total return – 2025 YTD

The point about the dollar is important because Trump wants it lower to adjust the US terms of trade. By my calculations, the cost of living is 16% above the rest of the developed world, having been 27% in the recent past. We have seen dollar-falls before, and this overvaluation is the primary reason I have been so reluctant to embrace US equities since late 2020.

US Dollar Index Purchasing Power Parity

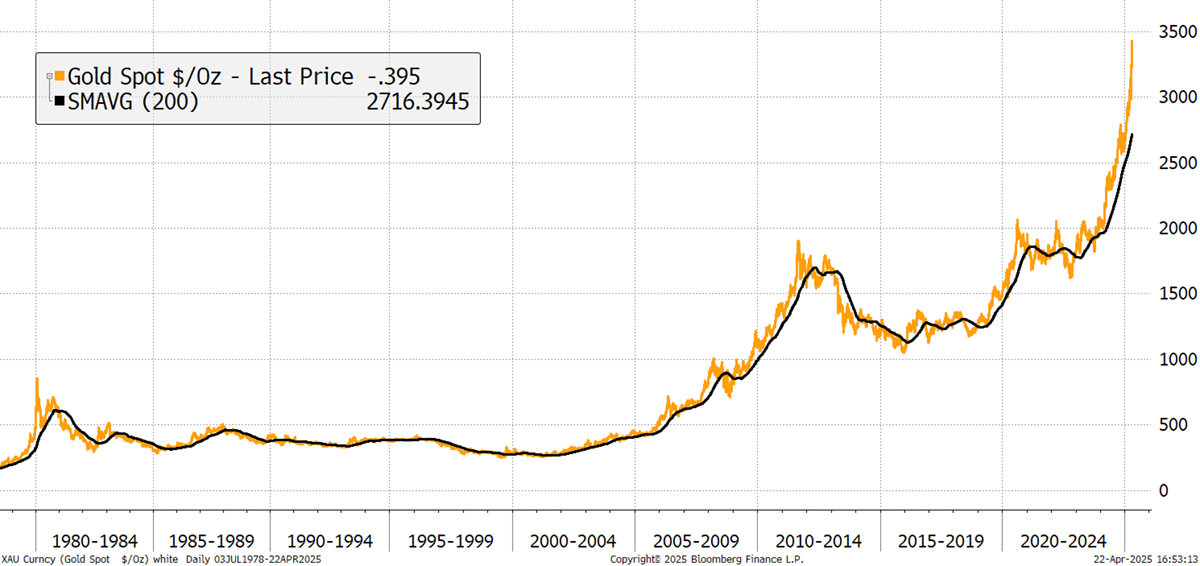

Gold has been the star but is now extended from the trend. The break above $2,000 finally came in late 2023, but on Monday, it touched $3,500. That’s too much, too soon. To be clear, I remain bullish long-term, but it’s time for a pause. A key measure during strong bull runs is the extension from the trend. When that begins to accelerate, the risks rise.

Gold in USD since 1978

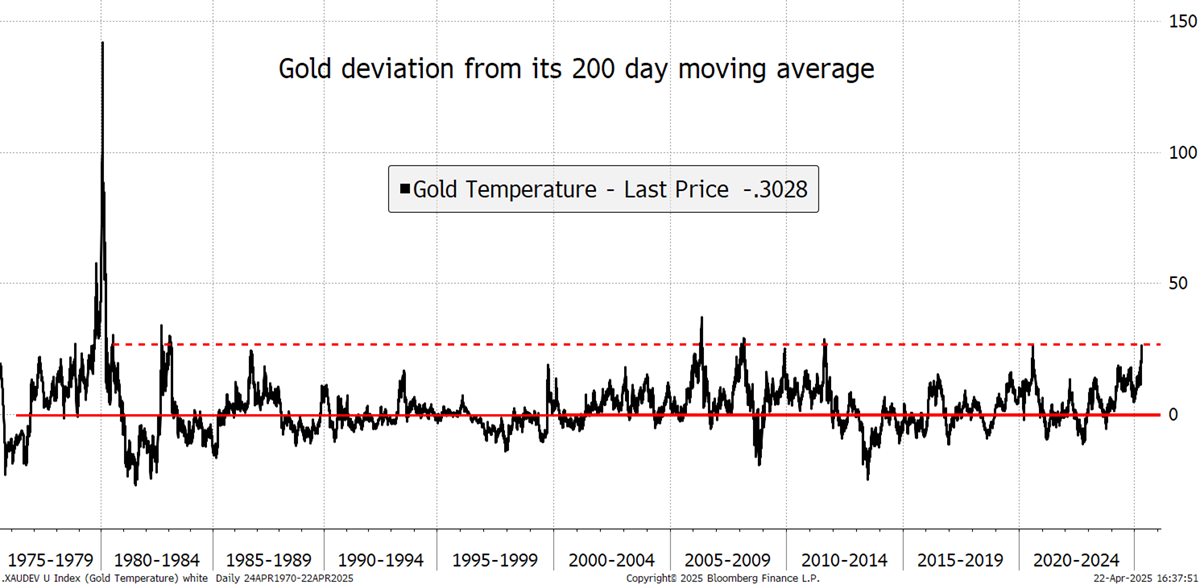

The price of gold in USD is now 26% above its 200-day moving average. That is high and is extended from the trend and, therefore, overbought. It matches the levels seen in mid-2020 and late 2011, which led to lasting corrections. That said, it also reached this level in 2006 and 2008, which saw short corrections. I can’t ignore the fact that it was 140% above trend in 1980, and we may see that again one day, but we don’t know when that might happen.

Gold Deviation from Trend

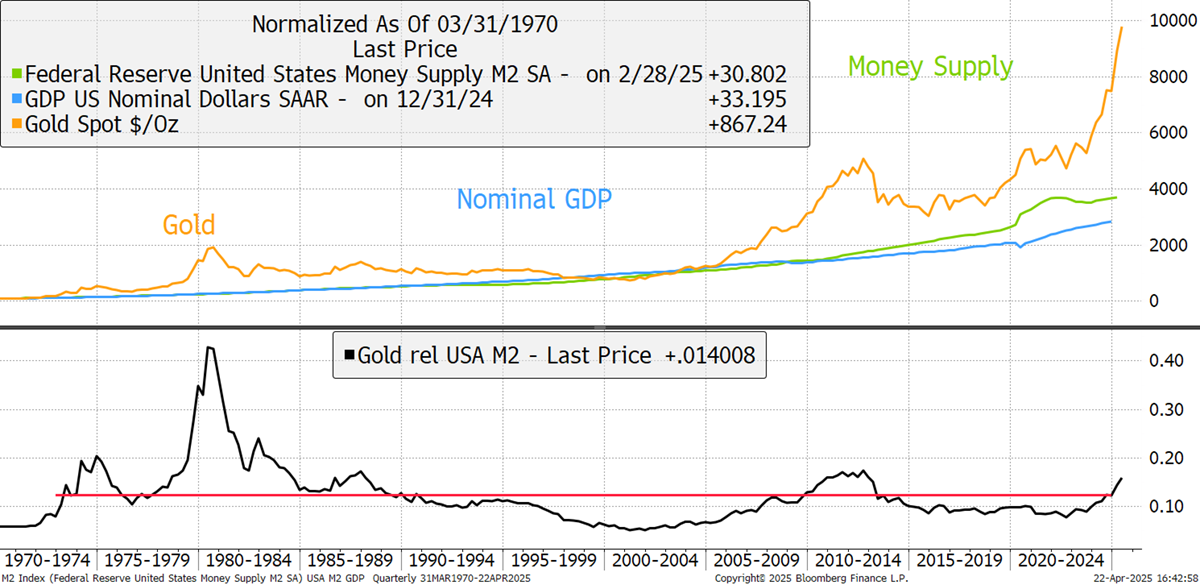

A more bullish comparison would look at the gold price compared to the US money supply. It is now above the long-term average, but not alarmingly so. More to the point, President Trump wants to print more money, and what Trump wants, Trump gets. The bull case is that gold is forewarning us that the printing presses are getting warmed up.

Gold, Nominal GDP, and the Money Supply – since 1970

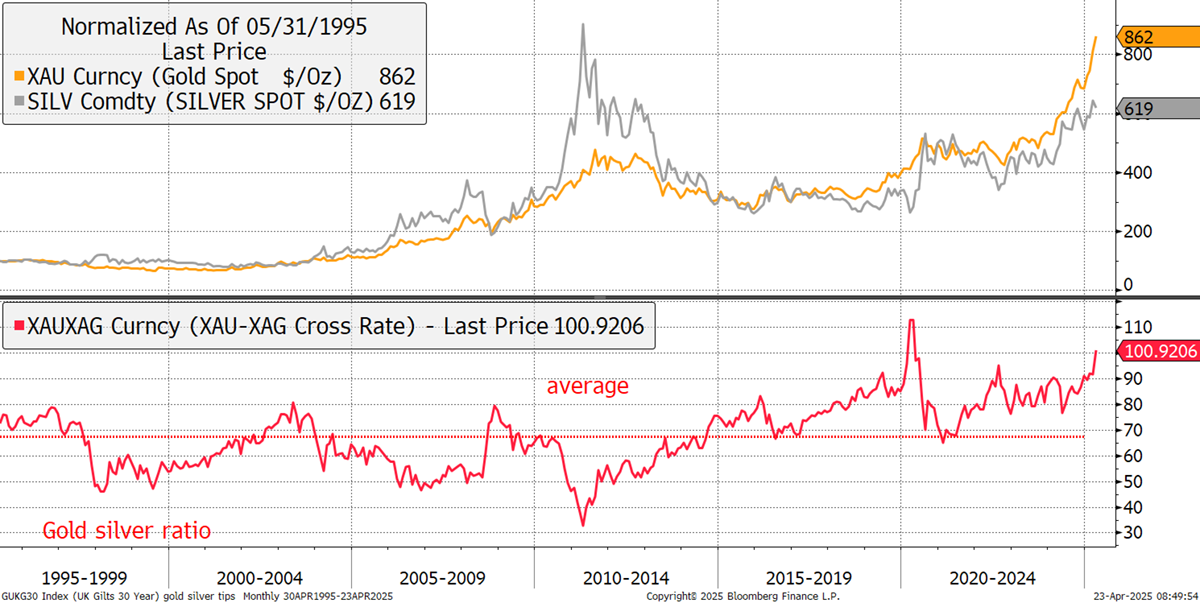

The gold mining stocks have been acting well and, while not yet getting in front of the gold price, are certainly keeping up. Gold and silver have delivered similar returns over many years, but this cycle, silver has lagged behind. The good news (or bad news) here is that the gold-to-silver ratio recently touched 105 (not shown on the red monthly chart), which is similar to the divergence during the pandemic. What happened next? Silver doubled within weeks. There is no reason this shouldn’t be repeated. That’s not a hard prediction, but a precedent.

Gold, Silver, and the Gold-to-Silver Ratio

The other good news is that since silver has lagged gold this year, it is not selling off with gold, which boosts portfolio diversification. One thing that has changed over the years is that silver is no longer gold’s primary challenger; that role has shifted to Bitcoin.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd