Life’s Essentials - Food and Clothing

Trade in Whisky;

I hope you’ve survived the recent turmoil. It has been a stressful two weeks, and my highest priority has been capital preservation. That has meant reducing portfolio risk in the areas that might be impacted by the new world chaos. This week, I add a new company that focuses on life’s essentials. This rebalancing of different types of risk will boost diversification into a more defensive sector.

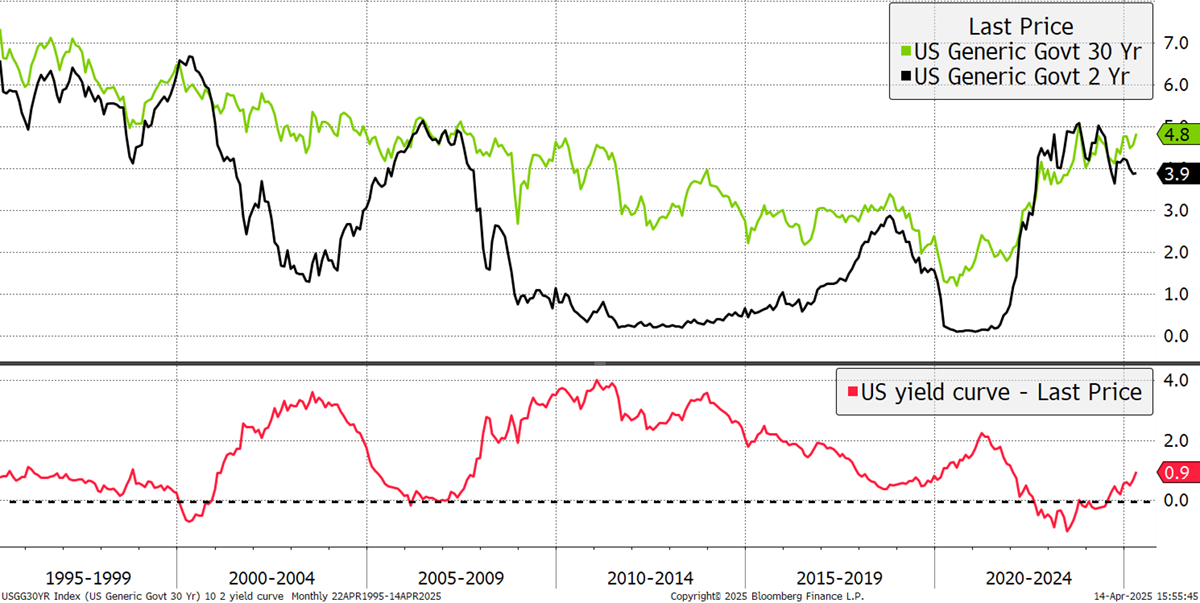

Before we get there, I want to update you on the key things that are happening in financial markets. One thing that stands out is the US yield curve. The 30-year yield is rising while the 2-year yield is falling. The yield curve is no longer inverted (red line below zero), like it was in 2022, but steepening.

The US Yield Curve Steepens

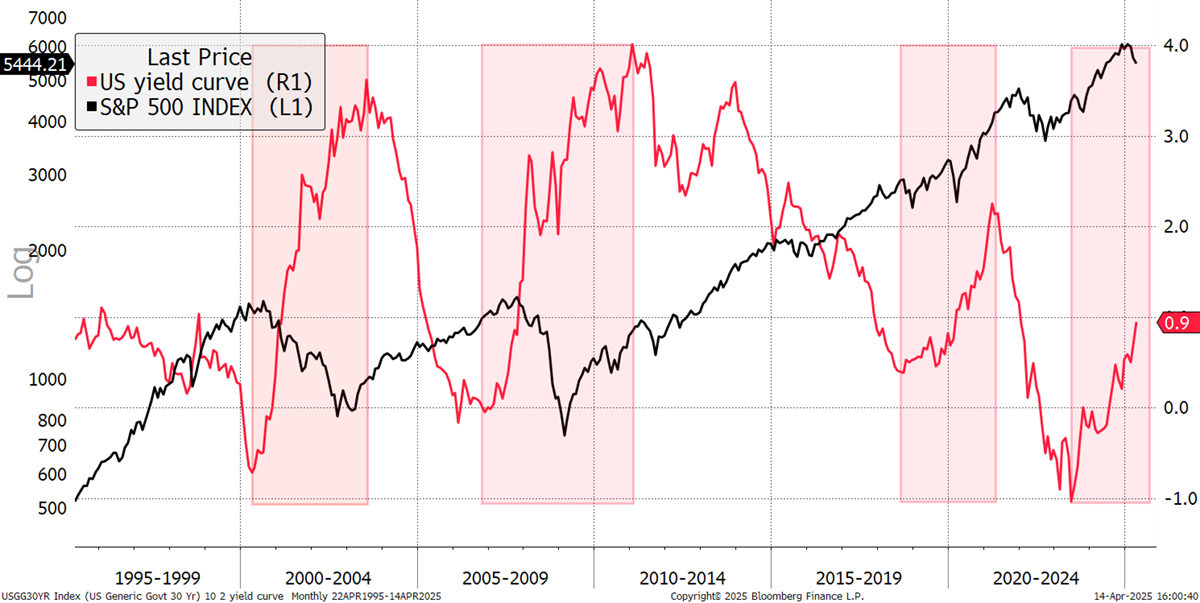

I have overlaid the yield curve with the S&P 500 and highlighted the periods of steepening. There are always many other factors to consider in financial markets, but the message is one of caution. In the 2000 to 2003 period, the S&P 500 fell sharply, just as it did when the steepening took place in 2007/8. QE and TARP saw an end to the bear market despite continued steepening into 2009/10. The next period of steepening took place in 2018, which led to what looks like a minor shock but didn’t feel like it at the time. Then, there was the pandemic shock, which saw the market fall again during steepening. Obviously, Covid was the culprit at that time, but perhaps the market reaction might not have been so bad under the same circumstances. It’s happening again.

The US Yield Curve and the Stockmarket

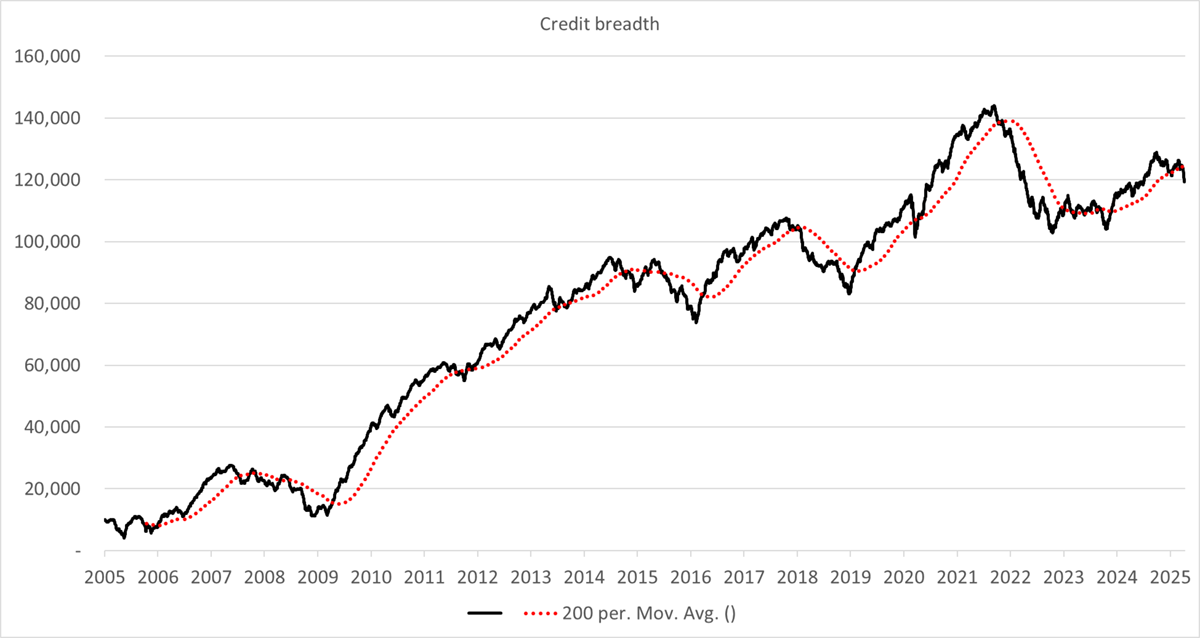

I would add that my very simple credit model, which I have wheeled out on several occasions in the past, has turned down. This takes the US Financial Industry Regulatory Authority (FINRA) bond data measuring the risers vs fallers each day. Whenever the cumulative line is below the red trend, it means more bonds are falling than rising, and credit conditions are deteriorating. This gave sell signals in 2007, 2015, 2018, 2022 and recently. It is not a great backdrop either, no matter the recent tariff relief.

US Credit Conditions Are Deteriorating

Tariffs have dominated the news wires, but something less reported and similarly important is the impact on shipping. I spoke to my nephew in Singapore, who works in the industry, and he explained the new restrictions on Chinese ships. In a nutshell, half of the world’s ships are built by, owned by, or managed by China. They face heavy penalties if they dock in the US, meaning the global fleet essentially needs to be split in half. This is another global trade bottleneck in the making, not dissimilar to the impact of the Ever Given, which blocked the Suez Canal. Getting goods to market just became a whole load more complex. The prediction market Polymarket now has the odds of a US recession at 50% in 2025.

There’s also been a dramatic fall in the value of the dollar. The main beneficiaries have been the euro and the Swiss Franc. Curiously, the yen has seen much less upward pressure than I would have expected. The pound has held up well too, along with the Swedish and Norwegian Krona. With the Chinese Renminbi also sliding against the dollar and emerging currencies along with it, this does imply that Europe is looking to become the global safe haven, which is welcome news.

Dollar

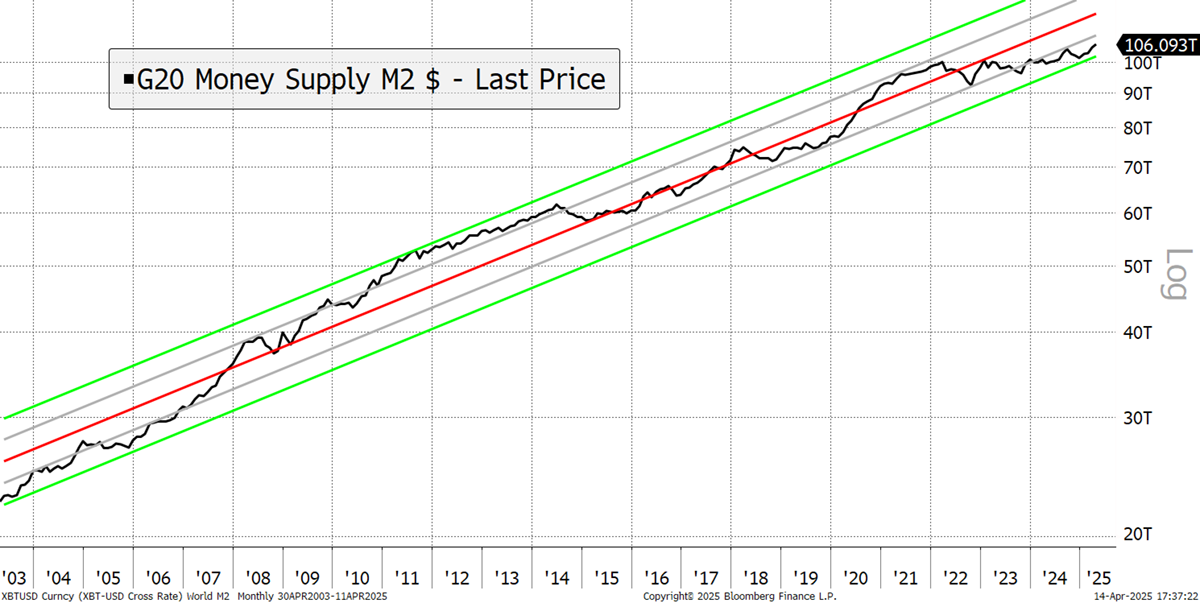

This means we should be selective about which currencies we should hold. A falling dollar has started to see the global money supply pick up. I would expect Trump to be a fan of a world awash with cash. While that sounds good for markets, it could well turn into an inflation problem. This is another development to watch, especially if interest rates start falling, which will likely further steepen yield curves.

The Global Money Supply Is Picking up

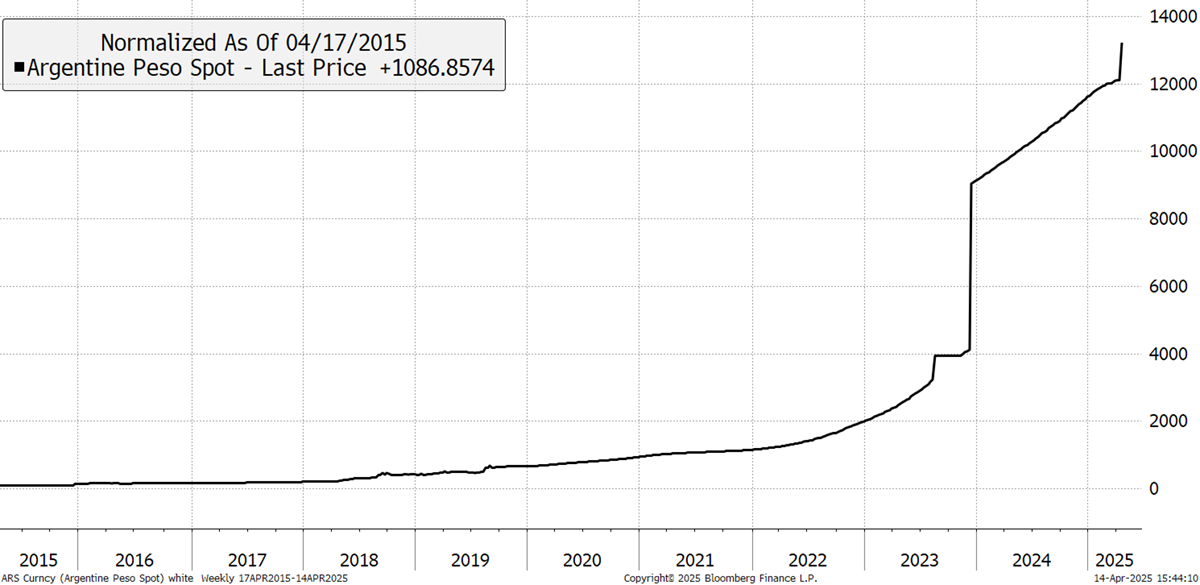

I would add another piece of important news. Just as the US and China are becoming more insulated, Argentina is going the other way and has floated the peso. The move on Monday saw a 12% devaluation, but it saw the stockmarket rally hard, even after adjusting for the currency’s fall.

Argentina

I highlight this because Millei’s economic liberalisation is something we don’t see these days. Inflation has fallen from 25% per month to 3.7%, and the budget has been balanced. Economic growth has picked up, and consumer confidence has improved. It’s a tough transition, but we can thank Argentina for reminding us of the benefits of free markets at a time when other countries are headed in the opposite direction.

Closed-ended Fund and Investment Trusts Update

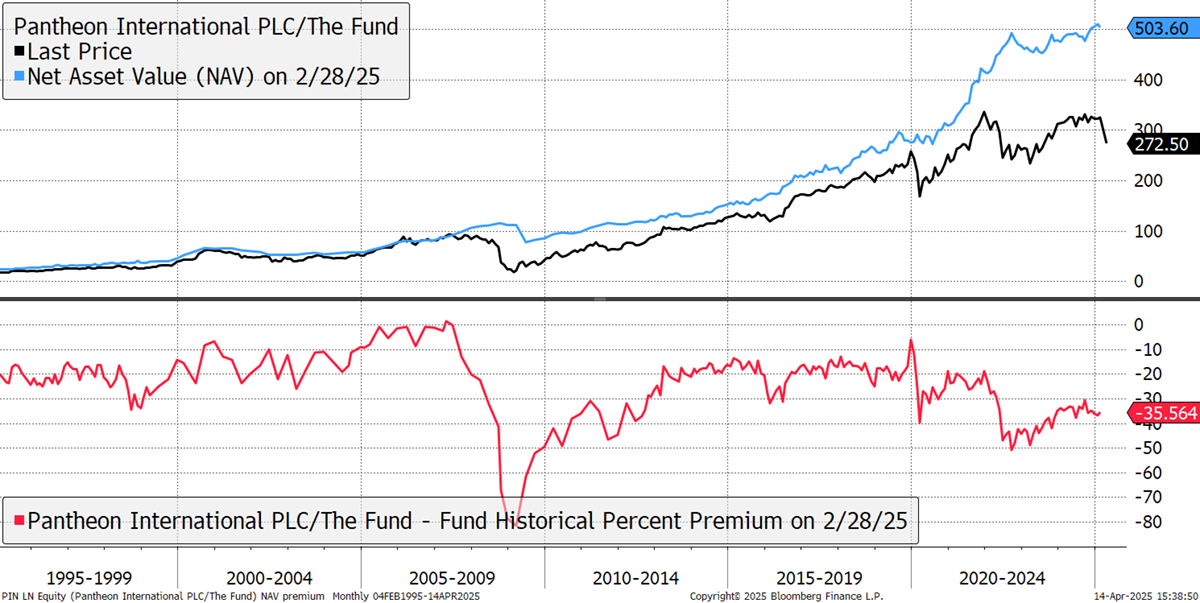

Before I come to the trade, I wanted to look at the private equity we hold in Soda. Exposure is modest, and while the liquidity risk has risen, valuations are low. In Pantheon (PIN), the discount to net asset value (NAV) is 35%, or 45% compared to January’s valuation.

Pantheon Net Asset Value

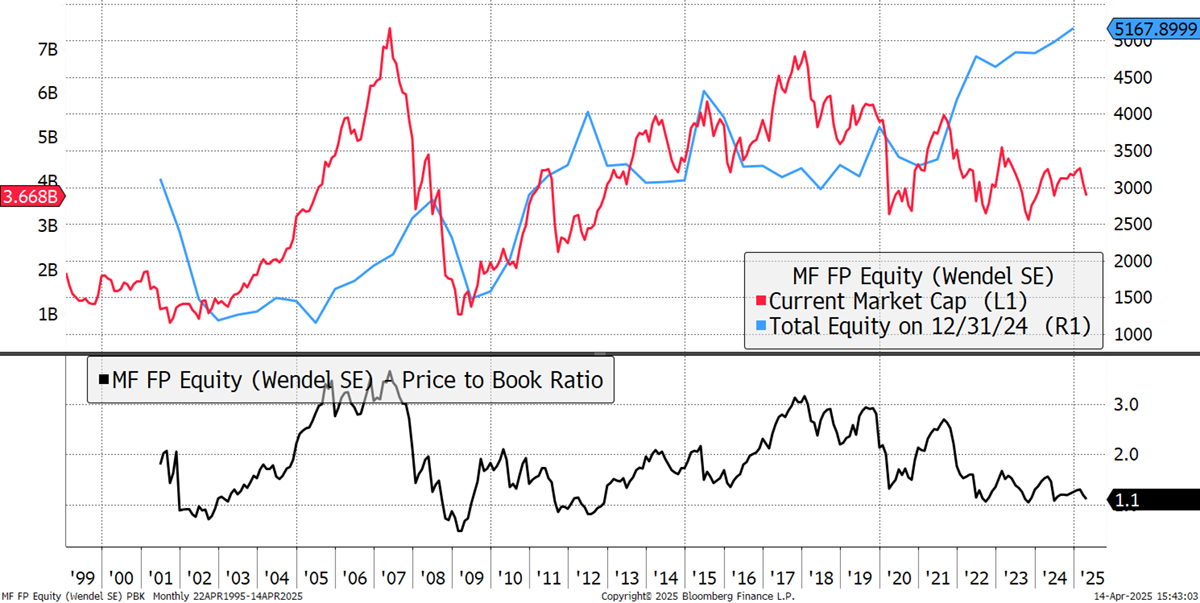

The other one is Wendel (MF France), which has also grown book value five-fold since 2009 and trades on 1.1x book, which is the bottom of the range. In both cases, valuations are very low and provide a margin of safety.

Wendel Book Value

The Capital Gearing Trust (CGT), along with Ruffer (RICA), has held up well in recent weeks. CGT published their Q1 review, which reiterated their defensive stance. They showed this chart, highlighting how the discounts of alternative investment trusts had blown out considerably more than equity investment trusts. It makes a good point, and one day, we’ll get back to the pre-2022 era and sell these at high prices.

Investment Trust Discounts by Asset Class

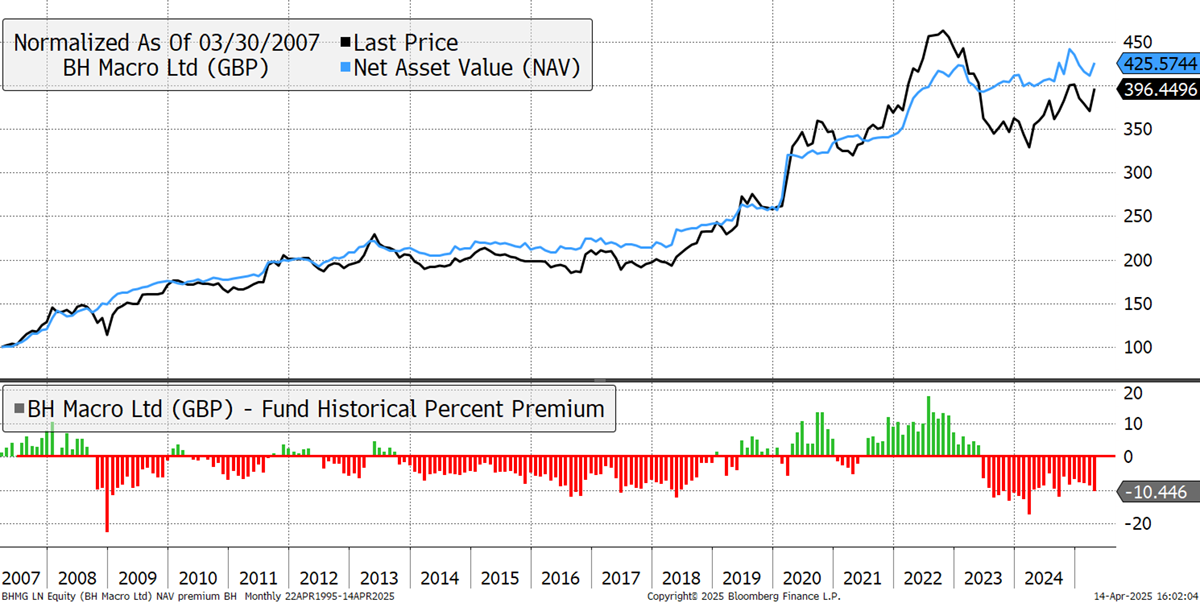

The last closed-ended fund I wanted to mention was BH Macro (BHMG). It has also had “a good crisis” while the discount has closed this year following the continuation vote. They don’t disclose their strategy, but they are highly competent and are a great diversifier during these times.

BH Macro

Bull or Bear Market

My instinct is that the World Index is entering a bear market, and this is the start of something that can last for a year or two. But I remain convinced the epicentre will be the richly valued US companies, and the rest of the world will be the safe haven, especially Europe. It is right to remain invested, but with more caution, and with that in mind, I am adding a quality, defensive company to the Whisky Portfolio.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd